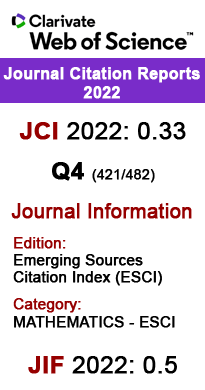

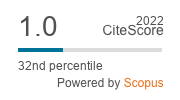

Malaysian Journal of Mathematical Sciences, December 2022, Vol. 16, No. 4

Estimation on Rational Speculative Bubbles in Stock Market by Using Generalised Johansen-Ledoit-Sornette Model

Borhan, N. and Halim, N. A.

Corresponding Email: nurharyantihusna@gmail.com

Received date: 7 February 2022

Accepted date: 20 September 2022

Abstract:

This paper discusses the generalized Johansen-Ledoit-Sornette (GJLS) model in determining and predicting the size of rational speculative bubbles in stock market. In this study, the GJLS model is used as an approach to detect the presence and prediction of rational speculative bubble sizes of the stock market. The stock markets chosen in this study are Hang Seng, Nikkei 225 and S\&P 500. This is because China, Japan and United States are countries that pioneers the world economy. This paper presents step by step on finding the linear and non-linear parameters in the generalized Johansen-Ledoit-Sornette model using the Ordinary Least Squares method for the linear parameters and formulas for the non-linear parameters. There are 7 parameters that need to be identified which are A,B and C for linear parameter and $\omega$, $\varphi$, $\beta$ and t for the non-linear parameter. Then, the size of speculative rational bubbles is determined and predict using the GJLS model. The size of speculative rational bubbles for future cycle is forecasted. Then, the effect of the presence of rational speculative bubbles towards the economy is discussed.

Keywords: forecasting; generalized Johansen-Ledoit-Sornette; rational speculative bubbles; economic bubbles